City of New Philadelphia Income Tax Department

Due April 15th2024

The New Philadelphia Income Tax Department administrates the city’s income tax law. Income tax revenues are the city’s largest source of revenue for financing the operations of the city. Since New Philadelphia is a mandatory filing city, the employees in the Income Tax Office review all city income tax returns for residents and businesses. The employees also provide assistance to callers concerning their City of New Philadelphia income tax issues.

E-File Now Available

New Philadelphia Taxpayers CAN e-file taxes if:

• Your only source of income is a W-2 from an employer or a 1099-Misc not associated with a Federal Schedule C

• You have gambling or lottery winnings not associated with a Federal Schedule C

New Philadelphia Taxpayers CANNOT e-file taxes and must send in a New Philadelphia form if:

• You are a New Resident and this is your first time filing with the City of New Philadelphia

• You are a non-resident requesting a refund

• You are filing for a Business

• You have Federal Schedules associated with your return such as but not exclusive to:

o Federal Schedule C (self-employment income)

o Federal Schedule E (rental income)

o Federal Schedule F (farming income)

o Federal Schedule K-1 (partnership investment)

CLICK HERE IF YOU MEET THE CRITERIA TO E-FILE

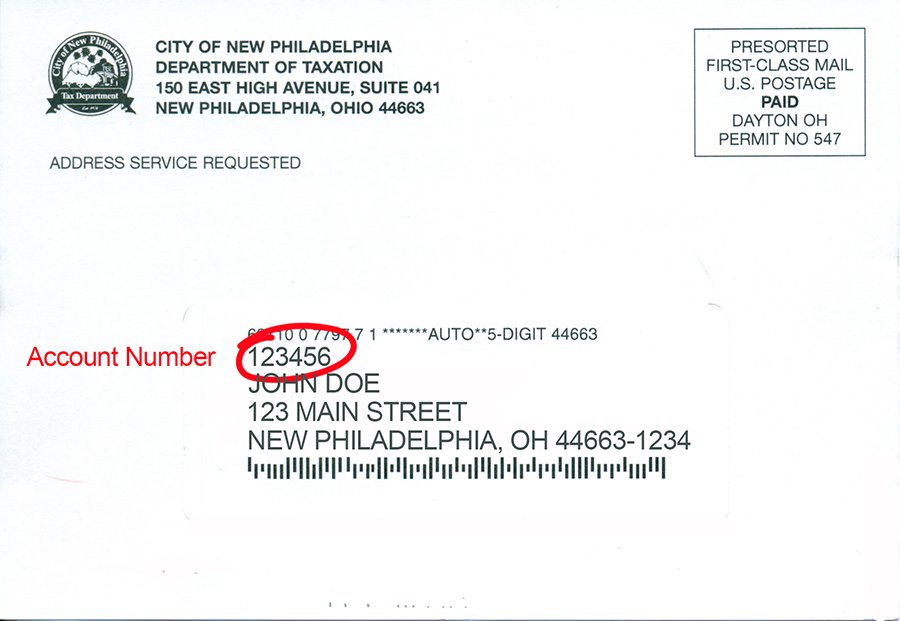

New Philadelphia has a new e-filing site! You will need to activate your new account to file. This process will be completed online through the new filing site. You do not need to contact the Income Tax Department directly to activate.

General Tax Information

- Income Tax Rate: 1.5%

- Tax Credit: 1.5% credit to New Philadelphia residents who work outside the city and pay taxes to other municipalities

- Estimated Tax Payments: Every taxpayer shall make a declaration of estimated taxes for the current tax year if the amount payable as estimated taxes is at least $200.00. Estimated tax payment forms are available on the right (Downloadable Documents).

Who Needs to File?

- If you are a resident 18 years of age or older, mandatory filing is required for all qualifying income

- If you are a non-resident 18 years of age or older and have qualifying income within the New Philadelphia city limits and New Philadelphia income taxes have not been paid or withheld

- If you own and/or operate a business within the New Philadelphia city limits

- If you own rental property within the city limits of New Philadelphia

- If you earn qualifying income from a business or pass-through entity for work done or services performed within the city limits of New Philadelphia

For an explanation of “qualifying income” see page two of the city’s Individual Income Tax Return form.

- If you are requesting that your account be inactivated due to moving from New Philadelphia with no intent to return, although retaining a mailing address within the New Philadelphia City limits as your address of record, please enter the date of your move and the reason, and attach supporting documentation with regard to your relocation to your income tax form.

Penalty and Interest:

The interest rate that will be applied to all unpaid income tax and unpaid withholding tax will be:

| Calendar Year | Monthly Interest Rate | Yearly Interest Rate |

| 2016 | 0.42% | 5.00% |

| 2017 | 0.50% | 6.00% |

| 2018 | 0.50% | 6.00% |

|

2019

|

0.58%

|

7.00%

|

|

2020

|

0.58%

|

7.00%

|

|

2021

|

0.42%

|

5.00%

|

|

2022

|

0.42%

|

5.00%

|

|

2023

|

0.58%

|

7.00%

|

|

2024

|

0.83%

|

10.00%

|

- Late Filing: $25.00

- Late Payment: 15% of the amount not timely paid

- Late Withholding Payment: 50% of the amount not timely paid

- NSF Check Fee: $35.00

Related Pages

Related Pages